PPOA Executive Director

wquint@ppoa.com

On September 10, the L.A. County Board of Supervisors approved the new Choices medical and dental premiums and life insurance rates for next year, beginning January 1, 2020. By now, all active employees should have received the open enrollment book in the mail for the Choices plans. You have the entire month of October to make any changes to your current insurance coverages. If you do not make any changes this month, your current coverage will roll over into 2020. So if you don’t want to change anything, no action is needed. But if you do want to make changes, you must do so by October 31.

If you have not received your Choices booklet, call (888) 822-0487 or visit mylacountybenefits.com to get a new enrollment packet as well as instructions on coverage enrollment.

There is plenty of news regarding the Choices plan. As you are aware, the Coalition of County Unions (CCU) and the County of Los Angeles negotiated for over one year after the June 30, 2018, expiration of the 2015–2018 Fringe Benefit Memorandum of Understanding (MOU). Successor MOU negotiations were particularly challenging because of the County’s mandate to lessen its liability associated with the Flores v. City of San Gabriel (9th Cir. 2016) case. The CCU and County largely agreed to resolve the Flores issues by placing “caps” on cash back received by members from the Choices plan, and lower than normal medical contributions in exchange for “sustainability bonuses” to offset the loss in taxable cash.

All full-time PPOA members enrolled in the Choices plan should have already received a one-time $500 bonus and an eight-hour holiday credit. Effective January 1, 2020, PPOA members will also receive an approximate 1% Choices Sustainability Bonus as an acknowledgement of the CCU members’ cooperation with maintaining the bona fide status of the Choices Cafeteria Plan. Reminder: Effective January 1, 2021, employees who have completed 12-plus months at top step will receive a 2.75% salary increase. Both increases are pensionable. PPOA members who have been receiving monthly taxable cash back exceeding $325 from the Choices plan will only receive up to a maximum of $325 taxable cash per month effective January 1, 2020. Despite many changes due to the Flores case, the news is still mostly positive for next year’s medical and dental rates.

In July, monthly health insurance contributions from the County increased for an employee only to $986.26; an employee plus one dependent to $1,799.45; and an employee plus two or more dependents to $2,125.70.

On November 1, monthly health insurance contributions from the County will increase for an employee only to $1,005.99; an employee plus one dependent to $1,835.44; and an employee plus two or more dependents to $2,168.21.

Except for Cigna Choices and CAPE Blue Shield Classic/PPO medical plans, the 3.5% County health contribution increase coupled with the 1.0% sustainability bonus beginning on January 1, 2020, should cover nearly all increases to the Choices medical/dental plans from current 2019 rates to 2020 rates.

The 2020 Delta Dental PPO plan rates for PPOA members will increase from current 2019 rates. Beginning in 2020, the monthly increase will be $1.56 for employee only; $2.66 for employee plus one dependent; and $4.08 for employee plus two or more dependents. PPOA members enrolled in the DeltaCare USA and MetLife/SafeGuard dental plans will not see a change in rates for 2020.

Optional group term life for represented employees will decrease 7.6% for 2020.

Dependent life and AD&D insurance rates for represented employees will remain unchanged for 2020. The contract rates are guaranteed through 2022.

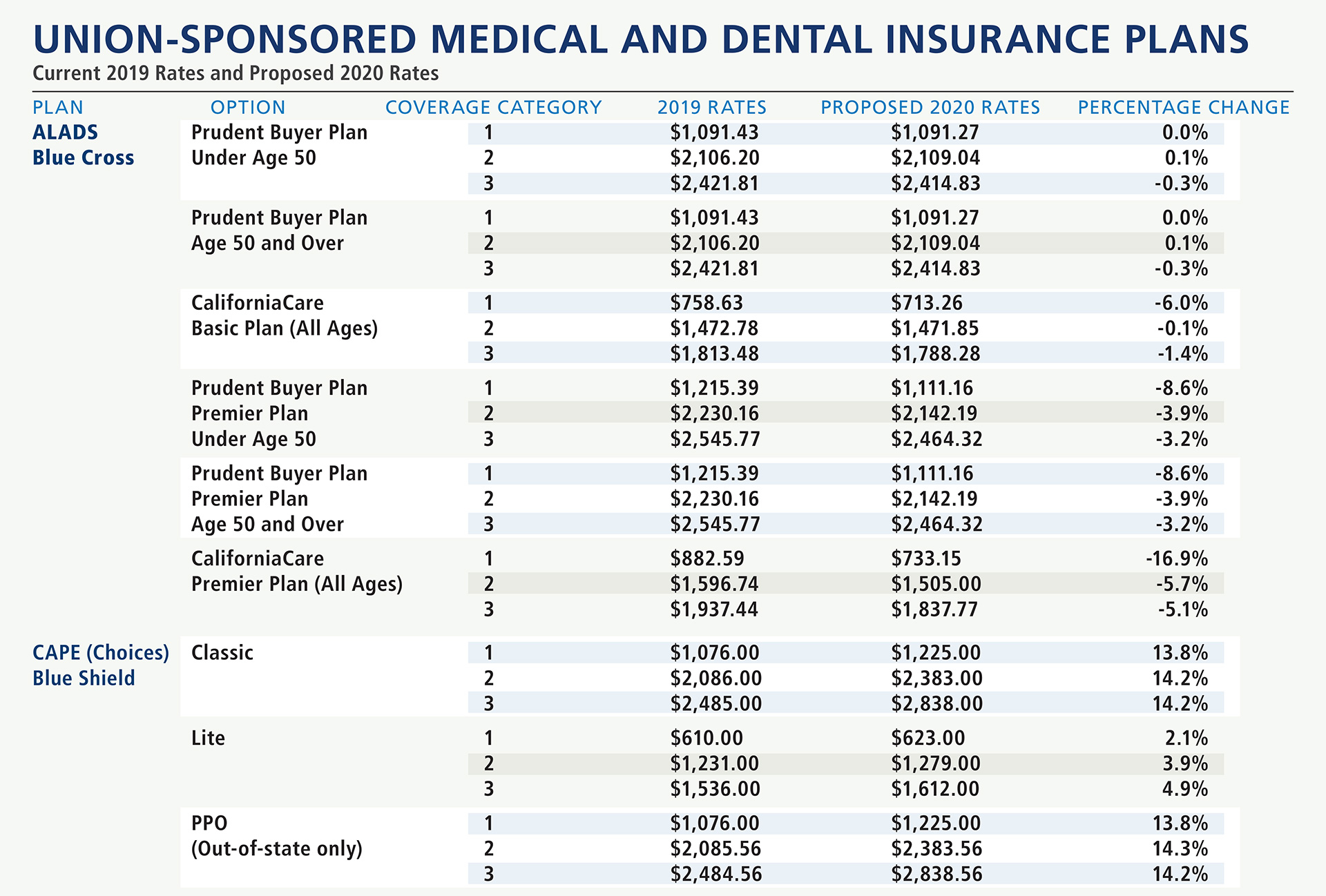

On page 5 and below, you will find the specific information on all Choices medical/dental plans, including current 2019 rates, new 2020 rates and the percentage increase/decrease for each plan. Any questions on these charts or any issues should be directed to the County Human Resources benefits department at (888) 822-0487, or call the County benefits hotline at (213) 388-9982.

If you would like to access the 2018–2021 Fringe Benefits MOU, please visit PPOA.com. (Click on the “Contracts” submenu located under the “Members” tab on the homepage.)

As you know, PPOA rejoined the CCU in August and looks forward to having a seat at the Fringe Benefits bargaining table in 2021 as the CCU collectively, with solidarity, negotiates the best possible benefits for all CCU members.